Academic Guanghua | How to Rectify and Enhance A-Share Market Valuation?

The SSE Composite Index recently has dropped down again after a temporary return to 2900 points. The undervaluation of the A-share market is undisputed, but the reason behind it is under-recognized. Numerous suggestions for market rescue have been offered, but most of them fail to touch on the root cause, that is, how should the A-share market be valued? What is its fair level?

An in-depth analysis of this issue is made in "The Valuation System with Chinese Characteristics: Theoretical Exploration and Policy Implications", the latest working paper in 2024 written by Liu Qiao, a professor of Finance at Guanghua School of Management of Peking University, Li Shangchen, a postdoctoral fellow at the Center for Financial Innovation and Development of the University of Hong Kong, and Zhang Zheng, a professor of Finance at Guanghua School of Management of Peking University. According to these three authors, prevailing pricing logic and valuation concepts in the A-share market are the fundamental cause for the undervaluation of the A-share market; to rectify and enhance A-share valuation, we must reconstruct the A-share market valuation system to form a fair level of A-share valuation.

The main viewpoints and relevant arguments in this article are taken from the three authors' latest working paper in 2024 titled "The Valuation System with Chinese Characteristics: Theoretical Exploration and Policy Implications".

Stock market investment is an important source of property income for residents. With more than 220 million A-share trading accounts, including over 50 million active accounts, stock market volatility has an impact on numerous households and is closely related to their willingness and ability to consume. As the SSE Composite Index successively fell below 3000 points, 2900 points and 2800 points, various suggestions have been offered to buoy up the stock market, such as suspending IPO, abolishing the registration system or canceling the short-selling mechanism; at the policy level, measures have also been successively put in place, such as suspending the lending of restricted shares and requiring state-owned enterprises (SOEs) to strengthen market value management. Undoubtedly, to boost investor confidence in the short term, the falling stock market must be reversed.

It is an indisputable fact that the A-share market is undervalued. As of January 30, 2024, the average price-to-earnings ratio (PE ratio) for companies included in the SSE Composite Index is only 11.96, while that for companies included in the Dow Jones Industrial Average is 26.3, indicating that the market valuation of A-share is much lower than that of U.S. stocks; another similar comparison also reaches the same conclusion: the average PE ratio for companies on the ChiNext is just 23.21, while that for the NASDAQ that also consists of growth enterprises is up to 43.6. We acknowledge the existence but fail to identify and pay enough attention to the cause of A-share's undervaluation. Numerous suggestions for market rescue have been offered, but most of them fail to touch on the root cause, that is, how should the A-share market be valued? What is its fair level? As a matter of fact, we cannot find proper measures to rectify or even enhance A-share market valuation unless we know the valuation logic of the A-share market and the fundamental cause of valuation deviations.

We believe that prevailing pricing logic and valuation concepts in the A-share market are the fundamental cause for the undervaluation of the A-share market; to rectify and enhance A-share valuation, we must reconstruct the A-share market valuation system to form a fair level of A-share valuation. Particularly, in the medium and long run, fair A-share market valuation is a key for the capital market to play a full pivotal role in facilitating the high-quality development of the real economy.

01

Significance of Realizing Fair A-Share Market Valuation

Price discovery is one of the most important roles of the capital market, that is, the process of setting the market price by buyers and sellers to help realize more efficient resource allocation and give to investors returns that are fair for the risks they have assumed. If the market price deviates from the fundamental value for long, the absence of price discovery function will lead to distorted demand and supply relationships as well as inefficiency or failure of resource allocation. This process is often accompanied by drastic financial asset price volatilities, bringing risks to the real economy and the financial system and causing losses to investors.

The Central Financial Work Conference held at the end of October 2023 made arrangements for "accelerating the building of a nation with a strong financial sector", requiring to "effectively strengthen the provision of high-quality financial services to major strategies, key areas, and weak links", and particularly, to direct more funds to flow to key areas and nodal industries that promote high-quality development. It is very important to promote high-quality financial development and give full play to the pivotal role of the capital market. If the A-share market has sensitive price signals (for example, fair valuation), it may become an important channel for resource allocation and policy transmission, while also providing fair returns for investors. The key is to explore the path of financial development with Chinese characteristics, improve the quality of the capital market's service provision and establish a valuation system that is highly adapted to the concept of Chinese path to modernization and the characteristics of Chinese economic growth.

At present, the prevailing valuation system for the A-share market is more concerned with listed companies' growth and financial performance. This means that they have to maximize shareholders' equity value and stress the pecuniary value. In our long-term tracking analysis of listed companies in China, we found that the average return on invested capital (ROIC) of A-share listed companies is only 3%-4%, while that of U.S. listed companies remains above 10% for long. Therefore, under the current market valuation logic, high A-share valuation has to be based on sustained growth (reflected in high PE ratios), but the market has repeatedly proved the falsity of listed companies' growth sustainability. Then, what's the fair level for A-share market valuation?

More importantly, the prevailing valuation system fails to reflect the prominent feature of China's economic development paradigm, i.e. "government + market", and the formation process of valuation fails to fully reflect the multiple connotations of "value". Under present institutional and development circumstances in China, an enterprise's value includes not only shareholders' equity value, but also many other dimensions of value, such as the values obtained from the enterprise by its employees, the government, creditors and other stakeholders by means of wages, taxes, interest and the like; by striving to be bigger and stronger, listed companies may motivate large, medium and small enterprises along upstream and downstream of the industrial chain and the supply chain to coordinate with each other, lay a solid micro-foundation for high-quality economic growth, and contribute to local employment, tax revenue and overall economic growth. Such dimensions are not directly reflected in financial indicators such as return on equity (ROE) or ROIC, and classic market valuation systems have not given enough attention and corresponding valuation premium to such enterprises. However, these values represent the people-centered development concept in the Chinese path to modernization and are highly consistent with the characteristics of China's economic development. "High-quality development should ensure that investors obtain returns, enterprises make profits, employees earn incomes, and the government receives taxes, and that all such gains correspond to their respective contribution as evaluated by the market." (Xi Jinping, 2021) The market valuation system that reflects the characteristics of high-quality development should give sufficient market valuation premiums to such dimensions, so as to form a fair valuation level. Only by doing so, can the capital market, through price discovery, effectively guide resource allocation and allocate more and better financial services to the sectors and areas that create these values. This is the rightful path for building a nation with a strong financial sector with Chinese characteristics to support high-quality development through finance.

02

A Fair Valuation System Should Include "Social Value" of Enterprises

Before using Chinese characteristics and values to reconstruct the valuation concepts and pricing logic for China's capital market, an important question needs to be answered: besides shareholders' equity value, what dimensions of value should be included in market pricing? How should these values be measured? In recent years, classic valuation systems have started to amend the relatively narrow understanding of the value, and gradually incorporated environmental, social and governance (ESG) considerations into investment strategies and the enterprise evaluation system. However, for the present, the capital market has no agreement on the definition and scope of ESG; its measurement is mostly subjective, and different valuation systems often produce quite different results; moreover, whether better ESG performance brings higher fundamental value and market valuation premium is not yet settled. Due to the ambiguity and uncertainty of its definition, scope, valuation methods and rating results, ESG value cannot fully reflect the valuation system's Chinese characteristics and Chinese assets' special value.

First of all, China's economic and social development is people-centered and inclusive. Under such a development perspective, the value of stakeholders that goes beyond the value of shareholders' equity is an important part of enterprises' value and should be included in the market valuation system to indicate the stock market's people orientation. Equally important, the combination of a well-functioning government and an efficient market is a prominent feature of China's economic development: the government works out "five-year plans" and industrial policies to allocate resources to nodal industries and key areas that promote economic and social development. Technological changes and impacts occurring in these nodal industries and key areas are spread and amplified through the production network to generate a spill-over effect and contribute to the emergence of a great number of upstream and downstream entities, with a multiplier effect on the overall economy, while heavy investment to these key industries and areas contributes to the growth of total-factor productivity and overall economic development. It is of great significance to include the multiplier effect on the overall economy generated by enterprises through the production network: nodal industries and key areas may not have a high return for invested capital, which may result in underinvestment, while the inclusion of the multiplier effect in the valuation will effectively resolve the issue of underinvestment by giving enterprises a much higher return and motivate more investment in these areas.

Based on the above two considerations, we introduce social value of enterprises as sufficient statistics for the value of Chinese characteristics in the market valuation system, that is, the value created by enterprises for all stakeholders times the multiplier effect on the overall economy spread and amplified by enterprises through the production network. The social value of enterprises reflects the value of Chinese characteristics that is highly consistent with the requirements of Chinese path to modernization and the characteristics of China's economic development, and needs to be incorporated into the market valuation system.

03

Social Value of Enterprises is Completely Omitted in the A-Share Market Valuation System

As shown by our empirical study, an enterprise with high social value has a better fundamental value (reflected in high ROE, more robust financial condition, ability to transcend cycles, etc.). The pursuit of social value will help enterprises build social capital and trust, maintain sufficient resilience before market volatility, such as financial crisis, face smaller litigation risk and financing cost, and make them easier to have the support from important stakeholders in case of any mergers and acquisitions or other transactions that may have a significant impact on the enterprises' value. All these mechanisms referred to in the classic literature will help enhance the enterprises' value.

More importantly, under China's growth paradigm of "government +market", enterprises with high social value are more likely to be at the nodes of China's economic production network, have a long industrial chain and supply chain and play a greater role in boosting the overall economy. These enterprises are easier to receive preferential treatment with respect to funding, supporting investment and financing, etc. Existing studies also indicate that China's robust economic growth since the reform and opening up is partly due to the preference of its industrial policies to nodal industries in the production network. Moreover, enterprises with high social value are more likely to seek for a balance between economic benefits and social benefits, and maintain a better balance between short-term value and long-term returns, between development and security, and between growth and stability. Such enterprises often perform better in terms of certainty, security and sustainability, and have a stronger ability to transcend cycles than other enterprises.

Enterprises with high social value should receive valuation premiums and give higher returns to investors. However, as a factor for pricing, enterprises' social value is completely omitted in A-share market's valuation system. According to our study, holding shares of enterprises with high social value may bring annual excess stock returns (alpha) of up to 8%-10% and a significant uplift of the enterprises' market valuation, and the existing pricing model cannot explain the excess stock returns arising from social value. Now that the risk level and other fundamental factors cannot explain the excess stock returns of enterprises with high social value, serious deviation must exist in A-share market valuation of enterprises with high social value, resulting in the undervaluation of these enterprises. Such valuation deviation is more apparent for large enterprises, central SOEs, SOEs, value-oriented enterprises and enterprises with high dividend yield. From a different perspective, listed companies in nodal industries are more likely to be undevalued, and investing in the stocks of such enterprises will help rectify market valuation.

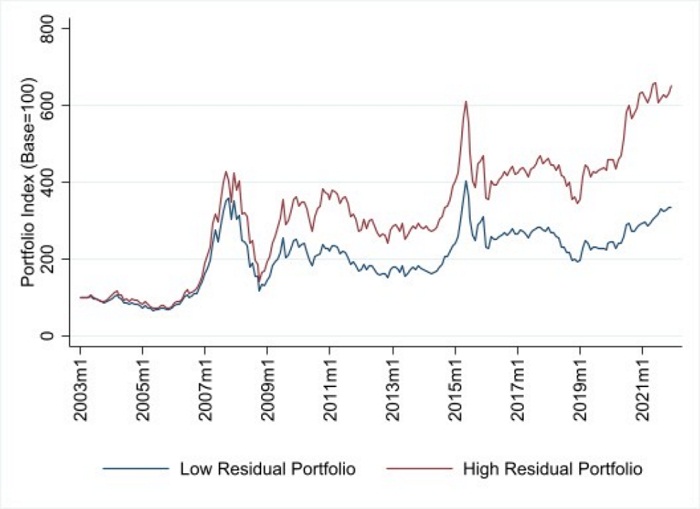

In the chart above, after controlling the impact of company or stock characteristics, A-share listed companies are divided into two groups, the one with high social value and the other with low social value, to construct the corresponding value-weighted portfolios (adjusted monthly) and calculate the cumulative return index for 1-month holding. As shown in the chart, the market value of the enterprises with high social value had an increase of near 5.5 times (from 1 to 6.5) in the period from 2003 to 2021, while the enterprises with low social value only had an increase of over 2 times; what's more, since 2009, including the stock market crash in H2 2015, the high residual portfolio clearly outperformed the low residual portfolio in the capital market, indicating that investment strategies that are based on the enterprises' social value can transcend different market cycles. This empirical fact once again shows that investors have not included social value in the valuation, so the investment portfolio of stocks of enterprises with high social value will bring higher stock returns. The chart below also shows the widening difference between the high and low portfolios since 2019, indicating that China's stock market has not redressed the mispricing of the enterprises' social value in recent years.

04

How to Rectify and Enhance A-Share Market Valuation Level?

It will be a prolonged and ongoing process to reconstruct the A-share market valuation system, inject Chinese characteristics and explore Chinese value, and efforts should be made at the same time on the side of investment as well as listed companies. On the side of investment, effective and active measures have to be taken to change investors' investment concepts and valuation logic, increase the number of investors that pay attention to the enterprises' social value and their influence on market pricing; on the side of listed companies, there should be positive actions to change their operation philosophy and their understanding of value connotation, turn their strategic, operational and management thinking to the track of creating social value, and provide the market with investment targets that have certainty, security and satisfy the needs of high-quality development. The logic behind the valuation system with Chinese characteristics that is conducive to high-quality development is not only rectifying valuation, but also creating value. To reconstruct the A-share valuation system, it is necessary for long-term funds that recognize social value and high-quality assets to effectively interact with and foster each other.

Below are specific policy measures:

Firstly, objective, adequate and complete information disclosure is the prerequisite for effective capital market pricing. For the present, most of the information in the financial statements of China's listed companies is about financial performance, and there is no systematic disclosure of non-financial performance information. Therefore, it is necessary to further regulate and strengthen information disclosure with respect to enterprises and social value, such as the position in the production network for the industry to which the listed company belongs, information about its supply chain and industrial chain, contribution made by the listed company to the stakeholders, and its social value. The disclosure of such information and stress of its important meaning for the valuation may form positively cycling and mutually reinforcing mechanisms by motivating investors to pay more attention to the enterprises and sectors that create social value, to explore the intrinsic value of enterprises with high social value, to construct the valuation methods that are consistent with their characteristics, and then, to rectify the valuation of these enterprises and facilitate them to create greater social value.

Secondly, investors are main players in market pricing, and the undervaluation of enterprises with high social value, for the most part, is due to deviated valuation of social value by investors, especially institutional investors. Therefore, it is necessary to strengthen investor education and leverage the role of professional institutional investors as a bridge, to guide institutional investors in the course of investment and research to pay more attention to the process of the enterprises' value creation for various stakeholders, to explore the information about the nodal role played by relevant enterprises in the production network, to have a better understanding of the room for enterprises with high social value to enhance their valuation in the medium and short run, and to increase the net buying of stocks of enterprises with high social value, and thus help rectify the valuation.

Thirdly, the logic of reconstructing the valuation for enterprises with high social value is that, compared with other enterprises, they may provide sure excess returns in the medium and long term. Therefore, to rebuild the valuation system, ongoing efforts should be made on the side of investment. On the one hand, it is necessary to increase guidance for medium and long-term funds, such as insurance, pension, social security and annuity, to match them fairly with enterprises with low valuation, good fundamentals and high social value, to form a positive cycle between listed entities and medium and long-term funds and to enable them to provide greater support to fair valuation. On the other hand, vigorous efforts should be made to foster long-term funds that are willing to give high premiums to social value. To be specific, social value may be used as the base for developing broad-based index products, such as relevant ETFs. For the present, since enterprises with high social value have higher return on investment, it is quite operable to promote relevant index products. By investing in listed companies with high social value, such index products not only can facilitate enterprises with high social value and undervaluation to rectify their valuation, but also can motivate more investors that are concerned with social value to hold relevant enterprises for long, thereby helping with the enterprises' long-term development and creation of social value. When long-term funds, such as index funds, are growing to account for a certain proportion of the total market value of the Chinese stock market, the pricing logic of the Chinese stock market may be changed, and social value will become an important source of valuation premium for relevant enterprises.

Fourthly, similar to the above, as a fundamental policy tool to support the development of the capital market with Chinese characteristics, a stock market stabilization fund can be set up with fiscal funds to give direct support to listed companies with high social value and undervaluation, and redress the deviated valuation.

Fifthly, A-share listed companies should be encouraged to center around social value creation to voluntarily upgrade their strategies, operation and management and enhance their quality and investment value. Specifically, enterprises should invest more in areas that create social value, keep improving their sustainability and core competitiveness and exploring their own value, strengthen effective and regular interaction with the market and continuously publicize their development concepts and value to the market to make investors have a better understanding of their intrinsic value. This is the core essence of market value management in the new development stage.

Sixthly, the systematic and ongoing study of the valuation system with Chinese characteristics for listed companies should be strengthened. The valuation system's Chinese characteristics may be different for different industries or different types of enterprises. From the perspective of the production network and stakeholders' value, we propose a relatively simple, operable and measurable method to define the connotation of "value" in connection with the valuation and to distinguish it from the ESG system. What we propose is a common logic, emphasizing that the connotation of "value" should be defined in accordance with concepts and patterns of economic development. While building the A-share valuation system based on social value, the one-size-fits-all approach should be avoided. In the future, the characteristics of different industries and different types of enterprises should be taken into consideration to allow differentiated valuation and pricing logic. For instance, for carbon neutrality-related enterprises, should their emission reduction be included in the scope of "social value"? Similarly, should science and technology enterprises' innovation investment, with positive externalities, be measured and quantified as "social value"?

To conclude: nothing is more dangerous than correctly answering the wrong question

The present outcry for the abolition of the registration system, suspension of IPO and cancellation of short-selling mechanism has not established any convincing causal connection to the rectification and enhancement of A-share market valuation. A real problem is that China's A-share market has not formed an effective pricing mechanism. These short-term measures may temporarily lift up the index, but cannot help establish a fair level of A-share market valuation. For example, should the fair valuation for the SSE Composite Index be 3000 points, or 4000 points, or 5000 points?

As above mentioned, for the purpose of forming a fair level of A-share market valuation, the policies should foster and introduce long-term funds that have risk-return requirements matched with the "Chinese characteristics" and "Chinese value" of China's listed companies, such as stock market stabilization fund and broad-based ETFs that are focused on investing in listed companies with high social value, and institutional investors that have adopted the new valuation system. Setting up such long-term mechanisms is the right answer to the right question.