ETF via Shanghai-Hong Kong Stock Connect

What is ETF via Stock Connect?

In July 2022, ETFs are included into the investment targets of the trading connectivity between the stock markets of Mainland and Hong Kong. Different from cross-border ETF products, the ETF via Stock Connect is an innovative business under the existing Shanghai-Hong Kong Stock Connect mechanism, which includes ETFs (exchange-traded funds) from the Mainland and Hong Kong markets that meet certain criteria into the scope of the connectivity. More specifically, Mainland investors can invest in ETF products listed on the Stock Exchange of Hong Kong mainly tracking stocks under the Hong Kong Stock Connect, and Hong Kong investors can invest in ETF products listed on the Shanghai Stock Exchange mainly tracking stocks under the Shanghai and Shenzhen Stock Connect.

Which ETF products can be included as the investment target of ETF via the Stock Connect?

The target ETF products need to meet the following criteria:

ETFs from the Mainland market

01The average daily asset size in the past six months needs to reach RMB1.5 billion.

02Among the constituent securities of the underlying index of the ETF, the weight of the stocks that are listed on the Shanghai Stock Exchange or the Shenzhen Stock Exchange must reach 90%, and the weight of the stocks that are eligible for the Shanghai Stock Connect or Shenzhen Stock Connect must reach 80%.

03The ETF product needs to have been listed for at least six months.

04The underlying index needs to have been published for at least one year.The eligible ETF list will be adjusted every six months.

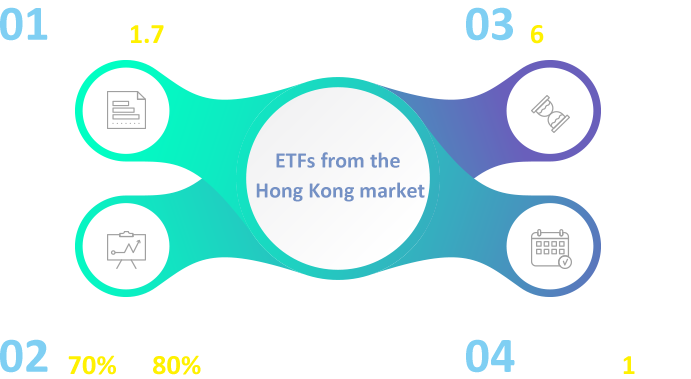

ETFs from the Hong Kong market

01The average daily asset size in the past six months needs to reach HKD1.7 billion.

02If the underlying index of the ETF is among the four flagship Hang Seng indices, the weight of the constituent stocks that are eligible for the Hong Kong Stock Connect must reach 70%; otherwise, the weight of the constituent stocks that are eligible for the Hong Kong Stock Connect must reach 80%.

03The ETF product needs to have been listed for at least six months.

04The underlying index needs to have been published for at least one year.Synthetic ETF, Leveraged ETF and Inverse ETF are excluded from the eligible stock ETFs.The eligible ETF list will be adjusted every six months.

What are the requirements for ETF products trading and investors’ suitability?

In terms of trading mechanism, daily quota, investor suitability, regulatory cooperation, clearing and settlement and risk control arrangements, the existing arrangements for stocks under the Stock Connect also apply for ETFs included into the Stock Connect. And related ETFs are only allowed for trading on the secondary market, not for subscription or redemption.

Daily quota

Included in the existing daily quota of Shanghai-Hong Kong Stock Connect.

Investor suitability management

No requirements of investor suitability management under Shanghai Stock Connect. In contrast, to meet the existing requirements of investor suitability management under Hong Kong Stock Connect, individual investors that participate in Hong Kong Stock Connect should have no less than 500,000 yuan(excluding the securities and money borrowed from securities borrowing and lending)in their securities account and capital account combined on average during 20 trading days prior to applying for trading through Hong Kong Stock Connect. Besides, investors should be evaluated comprehensively based on their assets, level of knowledge, risk tolerance and integrity profile. Institutional investors that participate in trading under the Hong Kong Stock Connect should comply with provisions of laws, administrative regulations, departmental rules, normative documents and business rules.

Why do we launch ETF via Stock Connect?

Since the launch of Shanghai-Hong Kong Stock Connect in November of 2014, the cooperation between mainland and Hong Kong capital markets has received attention and appreciation of investors from both markets. To further enrich the product category for investors and meet their demand of diversified cross-border investment and risk management, the launch of ETF via Stock Connect will promote the in-depth integration and common prosperity of mainland and Hong Kong, and boost the healthy and stable development of both markets.