Trading Arrangement

The SSE and SEHK each sets up a subsidiary. For southbound trading, mainland investors send their orders to the mainland securities companies who then submit to the SSE subsidiary. The SSE subsidiary is a special participant of SEHK and routes the orders to the SEHK. After the order is executed at the SEHK, transaction results are sent back to the investors via the same route.

For northbound trading, Hong Kong and overseas investors send their order to the Hong Kong securities companies who then submit to the SEHK subsidiary. The SEHK subsidiary is a special participant of SSE and routes the orders to the SSE for execution. Transaction results are sent back to the investors via the same route.

Trading Hours and Trading Calendar

Northbound trading follows SSE’s and SZSE’s trading hours. However, SEHK will accept Northbound orders from SEHK Participants five minutes before the Mainland market sessions open in the morning and in the afternoon.

| SSE Trading Session | SSE Trading Hours | Time for SEHK Participants to input Northbound orders |

|---|---|---|

| Opening Call Auction | 09:15 – 09:25 | 09:10 – 11:30 |

| Continuous Auction (Morning) Quota | 09:30 – 11:30 | |

| Continuous Auction (Afternoon) | 13:00 – 14:57 | 12:55 – 15:00 |

| Closing Call Auction | 14:57 – 15:00 |

Trading days under the Shanghai-Hong Kong Stock Connect have to satisfy the following criteria:

- Both Shanghai and Hong Kong Market are open for trading.

- Banking services are available in both Mainland and Hong Kong markets on the corresponding settlement days.

This arrangement is essential in ensuring that investors and brokers will have the necessary banking support on the relevant settlement days when they will be required to make payments.

Trading Calendar will be determined and disclosed in advance by the two Exchanges.

For more information, please visit:

Trading Fees and Levies

| Items | Rate | Charged by |

|---|---|---|

| Handling Fee | 0.00487% of the consideration of a transaction per side | SSE |

| Securities Management Fee | 0.002% of the consideration of a transaction per side | CSRC |

| Transfer Fee | 0.002% of the consideration of a transaction per side | CSDC Shanghai |

| Stamp Duty | 0.1% of the consideration of a transaction on the seller | State Taxation Administration (SAT) |

Clearing and Settlement

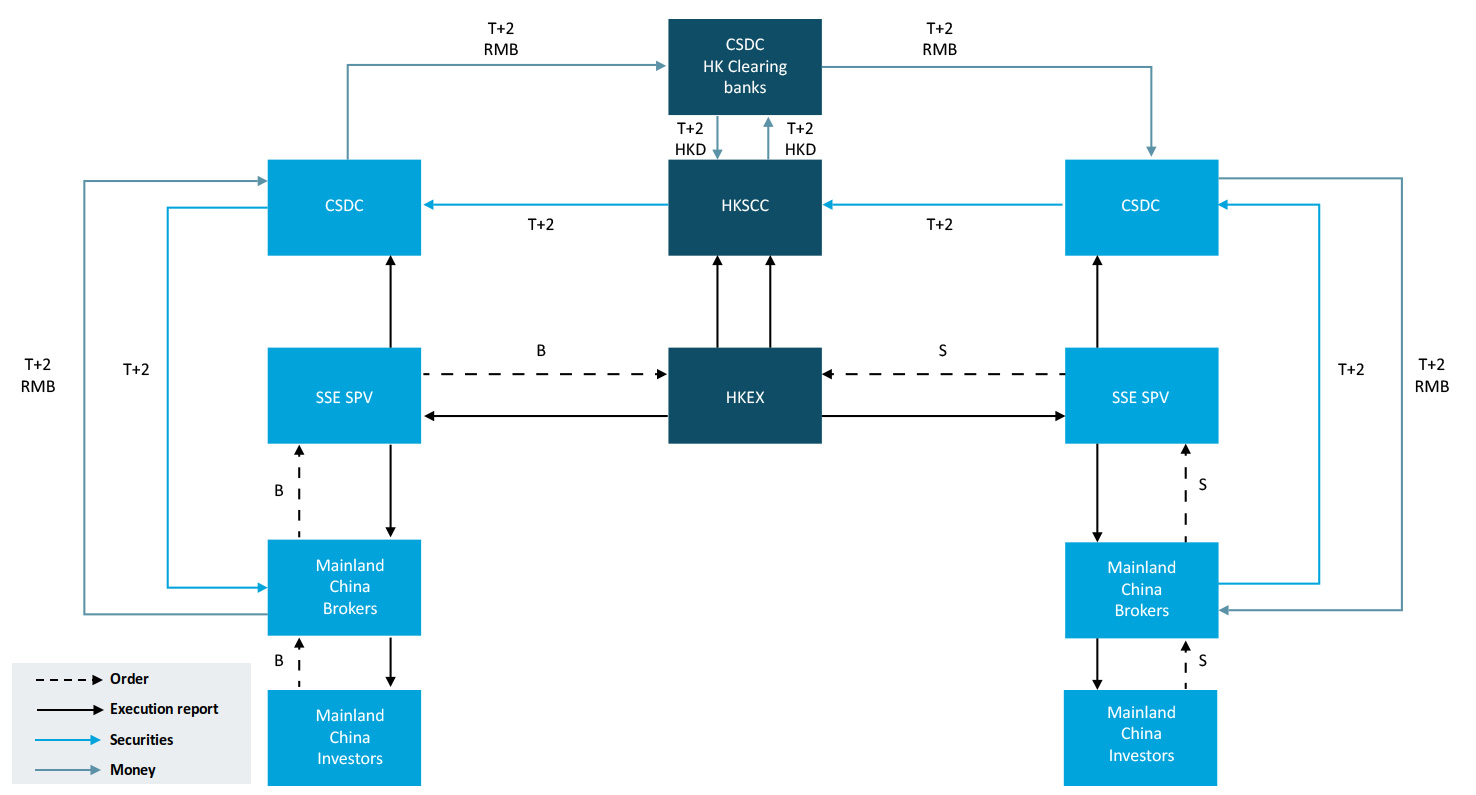

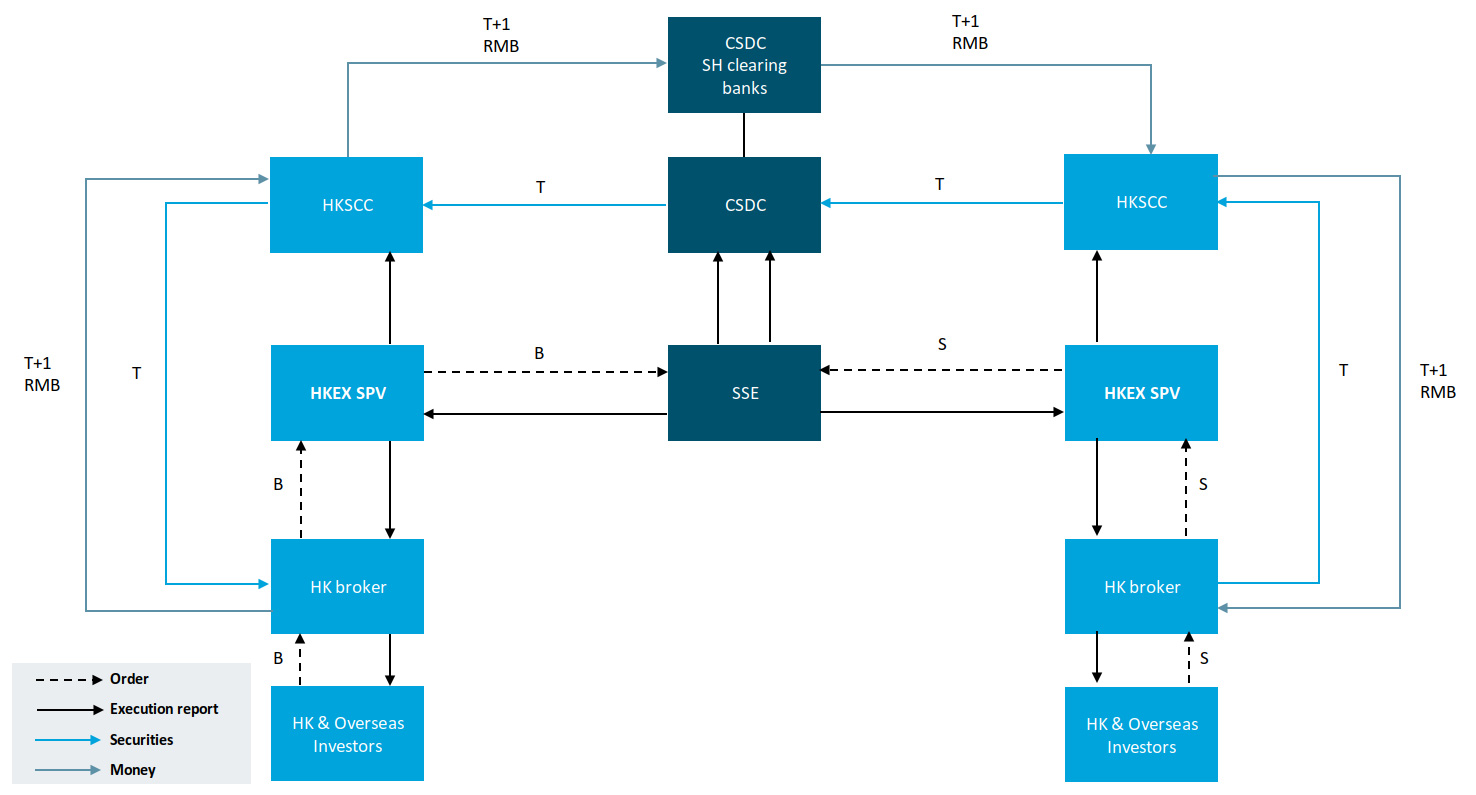

For clearing and settlement, CSDC and HKSCC established a clearing link and became each other’s clearing participant to provide clearing services for Shanghai-Hong Kong Stock Connect. In other words, CSDC and HKSCC will settle with each other and undertake the settlement obligations of their respective clearing participants’ trades.

For Northbound trades, HKSCC opens and maintains an omnibus stock account with CSDC and holds SSE securities in its omnibus account on behalf of CCASS (the Central Clearing and Settlement System operated by HKSCC) participants. HKSCC settles for Northbound trades executed on SSE with CSDC on behalf of its clearing participants. Northbound trades are cleared and settled according to the settlement cycle of the Shanghai securities market. Hong Kong and overseas investors trade and settle SSE securities in RMB only.

For Southbound trades, CSDC holds HK securities in its omnibus account maintained in HKSCC on behalf of its clearing participants. CSDC settles for Southbound trades executed on HKEX with HKSCC on behalf of its clearing participants. Southbound trades are cleared and settled according to the settlement cycle of the Hong Kong securities market. Mainland investors trade HKEX securities in HKD only and settle the trades in RMB.

When Hong Kong and overseas investors sell their A shares or mainland investors sell Hong Kong shares, the funds flow back to their home market bank accounts and cannot be used for speculation in other asset classes in the destination market.

Northbound Trading and Settlement Flow

Southbound Trading and Settlement Flow