Brief Introduction

The Shanghai-Hong Kong Stock Connect was officially launched in 2014. The stock connect established a two-way trading link between the Shanghai Stock Exchange (SSE) and the Stock Exchange of Hong Kong Limited (SEHK), a wholly-owned subsidiary of Hong Kong Exchanges and Clearing Limited (HKEX). The stock connect allows qualified mainland China investors to access eligible Hong Kong shares (Southbound) as well as Hong Kong and overseas investors to trade eligible A shares (Northbound) subject to a certain amount of daily quota.

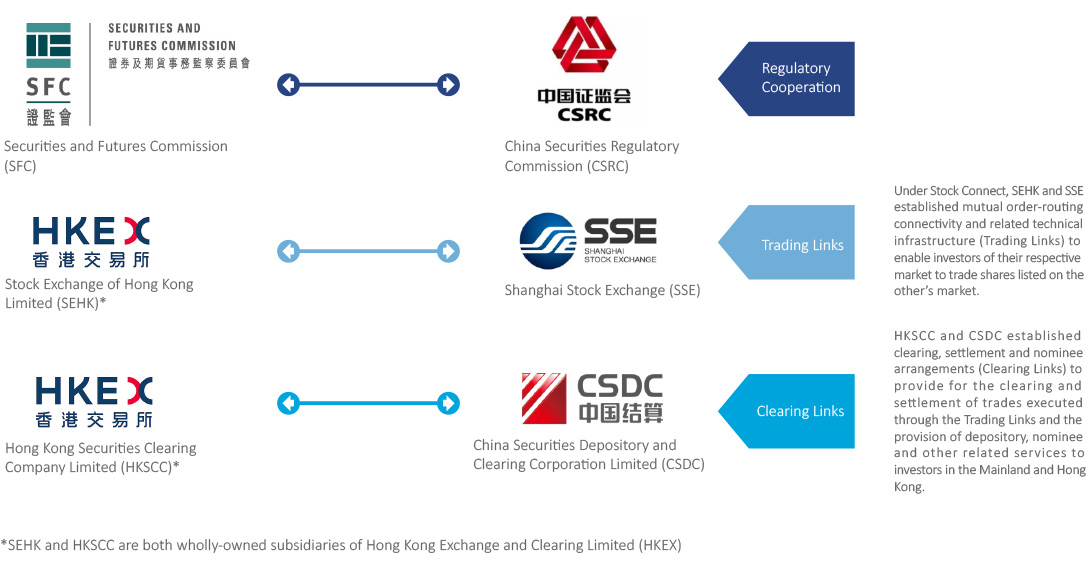

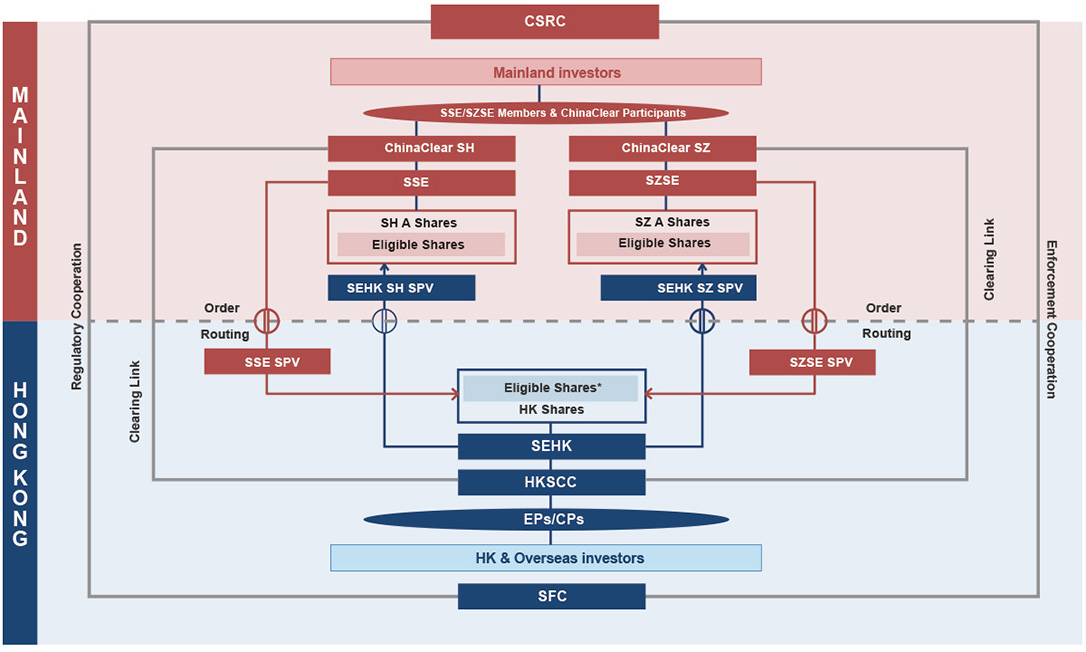

Framework

History and Development

2021.2.1

STAR Market-listed shares that are constituent stocks of the SSE 180 Index or the SSE 380 Index, or are the A-shares of A + H companies, were included in the Northbound Eligible Stocks

2018.10

Front-end controls for northbound trading went online

2018.9

The Northbound Investor ID Model officially launched

2018.5

Daily quota increased by 4 times

2016.12.5

The SZ-HK Stock Connect launched

2016.8

Aggregate quota abolished

2014.11.17

The SH-HK Stock Connect launched

2014.9

SSE published relevant rules

2014.4

Premier Li Keqiang announced the SH-HK Stock Connect

2012.12

First meeting between SSE and HKEX

In December 2012, the SSE's proposal for interconnecting the stock markets of Shanghai and Hong Kong received a positive response from the HKEX.

Afterwards, with the support of the CSRC, the SFC, relevant ministries and Shanghai Municipal Government and other parties, the SSE and the HKEX conducted program design and discussions on various aspects of Shanghai-Hong Kong Stock Connect in a highly confidential way.

On April 10, 2014, Premier Li Keqiang officially announced the Shanghai-Hong Kong Stock Connect program at the Boao Forum for Asia.

In the subsequent six months, the SSE, together with the SEHK, the CSDC and the HKSCC, achieved fruitful results in preparing for implementing the program, completing the preparatory work in rules, protocols, business, technology, market, surveillance and risk control, etc.

Since its official launch on November 17, 2014, Shanghai-Hong Kong Stock Connect has been in smooth operation and has realized the expected results.

On August 16, 2016, the aggregate quota of the Shanghai-Hong Kong Stock Connect was lifted.

On May 1, 2018, the Northbound daily quota was increased from RMB 13 billion to RMB 52 billion, and the Southbound daily quota from RMB 10.5 billion to RMB 42 billion, to better meet the investment needs of mainland and Hong Kong investors.

On September 26, 2018, the Northbound Investor ID Model was officially launched.

On October 22, front-end controls for Northbound trading based on the Broker-to-Client Assigned Number (BCAN) went online, which can automatically reject ineligible trading requests, thus enhancing the mechanisms of cross-border regulatory cooperation and providing mainland and Hong Kong investors with a better market environment.

February 1, 2021,STAR Market-listed shares that are constituent stocks of the SSE 180 Index or the SSE 380 Index, or are the A-shares of A + H companies, were included in the Northbound Eligible Stocks.