Securities Times | Focusing on the Fourth Anniversary of the STAR Market | The Vibrant STAR Market Yields Fruitful Outcomes as a Pilot Zone of Registration System

Excerpt translated from Securities Times

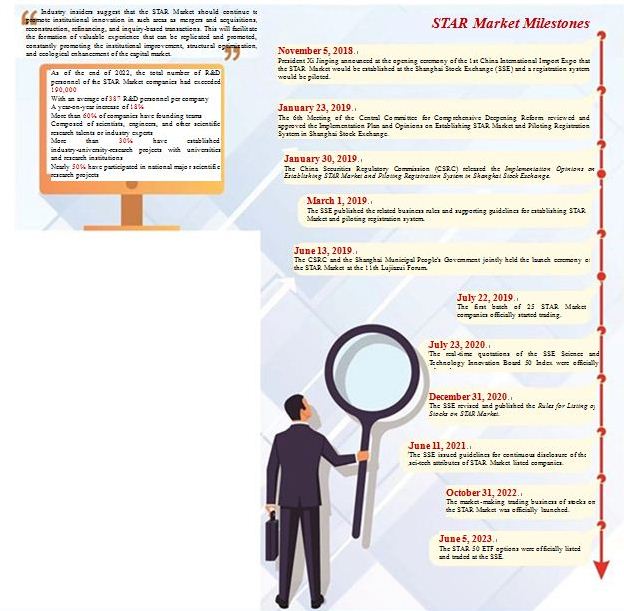

Tomorrow (July 22, 2023), the STAR Market will mark its fourth anniversary since its launch. Over the past four years, the STAR Market has undertaken a series of institutional innovations in such areas as issuance, listing, information disclosure, trading, delisting, and continuous supervision. It has developed valuable experience that can be replicated and promoted, providing beneficial reference for the reforms of the ChiNext board, the Beijing Stock Exchange, and the Main Board, and promoting smooth implementation of the comprehensive registration system.

During these four years, safeguarded by the registration system, the STAR Market has witnessed an abundant influx of capital and fostered a fertile ground for sci-tech innovation. As a "pioneer of the registration system", the STAR Market has become the preferred listing platform for Chinese companies with key and core technology, preliminarily forming a market ecosystem that supports sci-tech innovation. As of July 20, 2023, there have been 546 listed companies on the STAR Market, with a total market value of A-shares reaching RMB 6.47 trillion yuan.

In the era of comprehensive registration system, how can the STAR Market continue to play its role as the "pilot zone for capital market reforms"? Several industry insiders interviewed by Securities Times suggest that the STAR Market should continue to promote institutional innovation in such areas as mergers and acquisitions, reconstruction, refinancing, and inquiry-based transactions. This will facilitate the formation of valuable experience that can be replicated and promoted, constantly promoting the institutional improvement, structural optimization, and ecological enhancement of the capital market.

Pioneer explorer of the registration system

On July 22, 2019, the first batch of 25 STAR Market companies were listed on the SSE. Since then, the STAR Market, as a pilot zone for capital market reforms, has officially embarked on exploring the path of the registration system reform in China's capital market.

The STAR Market, through its successful implementation of the registration system from scratch, has rightfully earned the title of "pioneer". Over the course of four years, it has effectively served as a pilot zone for capital market reforms, resulting in the fruitful establishment of numerous innovative systems.

This includes the coordinated promotion of reforms of the market-oriented inquiry and issuance system to pioneer the break of the 23 times PE (price-to-earnings) ratio limit set under the approval system; the continuous optimization of trading mechanisms to attract professional institutions and long-term investments; the establishment of a normalized delisting mechanism to facilitate a market ecosystem characterized by orderly entry and exit and survival of the fittest...

As of now, the median PE ratio of STAR Market companies is 46.6 times, featuring "one enterprise, one price", premium pricing for high quality, and premium for industry leaders.

"Since the launch of the STAR Market, its exploration of the registration system has been solidly progressing step by step. Innovative institutional explorations have been carried out in various aspects such as issuance, listing, information disclosure, trading, and delisting. Key institutional innovations like inquiry transfer and market-making securities borrowing mechanisms have been gradually introduced," said Li Zhan, Chief Economist at research department of China Merchants Fund, during an interview with Securities Times.

Montage Technology Co., Ltd., one of the first batch of STAR Market companies, has truly experienced the "reform dividend" brought about by the institutional innovation of the STAR Market in the past four years. Fu Xiao, Board Secretary of Montage Technology Co., Ltd., cited the innovation of the stock incentive system as an example. Apart from traditional incentive tools, the STAR Market has introduced the Class II restricted stocks, which has significantly increased the flexibility of the stock incentive system. "The company has successively launched three phases of stock incentive plans, all of which have adopted the use of Class II restricted stocks. With a comprehensive coverage rate of over 95%, the overall effectiveness of the stock incentive program has been remarkable."

Montage Technology Co., Ltd. has greatly benefited from the innovative pre-IPO inquiry transfer system of the STAR Market. Fu Xiao stated that "The company's shareholders have conducted a total of five transactions through the inquiry transfer system, with a cumulative turnover of approximately RMB 8.7 billion yuan, which has played an important role in promoting orderly 'relay' between early-stage and long-term investors and optimizing the investor structure."

Drawn by the STAR Market's integration of the entire process of "capital raising, investment, management, and delisting", a large number of private equity funds and venture capital funds have intensified their investments in sci-tech innovation enterprises. Data shows that 96% of the STAR Market companies received venture capital support before listing, with a total investment amount of RMB 600 billion yuan.

From encouraging the participation of company executives and core employees in subscription arrangements, to supporting the use of over-allotment options (commonly known as Green Shoe) and introducing market maker mechanism, the STAR Market continuously empowers sci-tech innovation enterprises through a series of institutional provisions.

Wu Guoyi, the Director, CFO, and Board Secretary of China Resources Microelectronics Limited, stated that the company is the first enterprise on the STAR Market to introduce the Green Shoe mechanism, which has effectively protected its investors' interests and stabilized the secondary market.

Li Feng, Deputy Dean of Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University (SJTU-SAIF), mentioned during an interview with the journalist that the pilot registration system of the STAR Market has improved the efficiency of capital market financing. Compared with the approval system, the registration system simplifies the listing process, shortens the review time, and lowers the access threshold, providing financing opportunities for more sci-tech innovation enterprises.

A set of effective institutional provisions explored by the STAR Market that have withstood market tests, including the transparent and predictable review and registration mechanism, have been successfully replicated and promoted to the Main Board reform this year.

"It is the accumulated experience from the institutional innovation of the STAR Market that has ensured the comprehensive registration system reform to mature and succeed," stated Tang Zhehui, Deputy Head Partner of Audit Services for Ernst & Young (Central China Region), to the journalist.

Cultivating companies and becoming the strong magnetic field for sci-tech industry agglomeration

Viewed from the perspective of promoting the aggregation of resources such as funds and talents in the field of sci-tech innovation, establishing the STAR Market and piloting the registration system has undoubtedly been the most important and effective policy measure to support sci-tech innovation in recent years. It has effectively leveraged national and social capital, attracted outstanding entrepreneurial and innovative talents, and promoted the virtuous cycle of capital in the sci-tech industry.

As of July 20, 2023, a total of 934 enterprises have been accepted by the STAR Market, with 546 companies listed, raising RMB 858.2 billion yuan in their IPOs. The total market value of their A-shares is RMB 6.47 trillion yuan. A group of enterprises that have both broken foreign monopoly and possessed strong independent innovation capabilities, as well as representative and leading enterprises in their industries, have been listed on the STAR Market.

According to Li Feng, this can be attributed to the more flexible and inclusive listing requirements of the STAR Market. "Compared to traditional markets, the STAR Market places greater emphasis on the sci-tech innovation capabilities and growth potential of enterprises, and its diversified listing standards are more in line with the characteristics and pattern of growth for sci-tech innovation enterprises."

The agglomeration and demonstration effects of the STAR Market are increasingly prominent. Among them, there are 101 listed companies in the integrated circuit field, accounting for half of the similar A-share companies. This includes the upstream design, midstream manufacturing, downstream packaging and testing, as well as equipment, materials, and other industries in the complete industrial chain. It brings together backbone enterprises such as manufacturing leader Semiconductor Manufacturing International Corporation, silicon wafer industry leader National Silicon Industry Group Co., Ltd., and domestic CPU leader Loongson Technology Corporation Limited.

An official from National Silicon Industry Group Co., Ltd. stated to the journalist that as an integrated circuit industry chain company, the company has, since its listing, continuously promoted key production line construction and R&D for forward-looking technologies and product upgrades through the STAR Market, thereby increasing market share and sales revenue. "By the end of 2022, Zing Semiconductor Corporation, a subsidiary of National Silicon Industry Group Co., Ltd., has achieved full-scale production of 300mm semiconductor silicon wafers at a monthly output of 300,000 pieces, with a cumulative shipment of over 7 million pieces. It is currently a leading domestic enterprise for large-scale production of 300mm semiconductor silicon wafer products."

Thanks to the support from the STAR Market, Montage Technology Co., Ltd. has continuously achieved sci-tech advancements since its listing, leading to a constant improvement of its overall competitiveness. "Seeking financing through listing on the STAR Market has provided strategic determination and confidence for the company to develop a series of internationally leading products and technologies through R&D," said Fu Xiao. "Prior to the listing, the company was only a champion in the field of memory interfaces. Through the IPO financing and innovative R&D, the company currently has dozens of products on sale or under development, achieving global leadership in multiple segmented fields. We have gradually grown into an internationally leading data processing and interconnect chip platform design company."

Moreover, the STAR Market has attracted up to 111 biopharmaceutical companies, making it a major global listing platform outside of the United States and Hong Kong. "The STAR Market, which positions itself as a 'key and core technology' platform, has been the best choice for Shanghai United Imaging Healthcare Co, Ltd. to enter the capital market." stated an official from Shanghai United Imaging Healthcare Co, Ltd. "Listing on the STAR Market has provided the company with sufficient capital security and endorsement for our sci-tech brand image." It is learned that one of Shanghai United Imaging Healthcare Co, Ltd.'s investment projects financed by raised funds is a high-end medical equipment industry fund, which is mainly used for the company's phase II R&D and production construction projects. With a total investment of RMB 3.126 billion yuan, the project is expected to generate annual sales revenue of no less than RMB 6 billion yuan after its completion and operation in 2025.

Among the biopharmaceutical companies listed on the STAR Market, 20 companies were listed according to the Fifth Set of Listing Standards of the STAR Market, 50% of which have achieved a market capitalization of over RMB 10 billion yuan.

The diverse listing standards have met the financing needs of sci-tech enterprises of different types and at different stages. Fifty-two companies unprofitable at listing, 8 companies with special shareholding structures, and 6 red-chip companies have been listed, which were originally only able to seek listings overseas. Benefiting from the inclusiveness of the STAR Market, these sci-tech enterprises have gained access to the domestic capital market.

As the first company to list domestically using the Red Chip structure, China Resources Microelectronics Limited has achieved multiple "firsts" on the STAR Market, such as being the first company to list as a "limited company" rather than a "limited liability company", and the first company on the A-share market to have its stock denomination in Hong Kong dollars instead of RMB. "The company's decision to go public on the STAR Market was carefully considered. The inclusive listing conditions of the STAR Market allow companies to evaluate their value based on their sci-tech innovation capabilities and development prospects, enabling them to focus more on sci-tech innovation and the realization of long-term value," said Wu Guoyi.

"Recently, I have conducted research visits to many STAR Market companies, and they feel particularly impressed by the support the board provides for the innovation of sci-tech enterprises," said Qiu Yong, Chairman of the SSE, at the 14th Lujiazui Forum held in June this year. "Over the past three years, the compound growth rates of the operating revenue and net profit of STAR Market companies reached 29% and 56% respectively, and the average R&D investment in 2022 reached 16%."

Song Tao, Vice President and Board Secretary of Beijing Kingsoft Office Software, Inc. (Kingsoft), said that listing on the STAR Market has raised the company's investment and financing capabilities, laying a solid foundation for R&D investment and technological innovation. In 2022, the company's R&D investment accounted for about 34% of its operating revenue, with R&D expenses increasing by 23.08% year on year.

The realization of the value of sci-tech personnel and innovation projects in the capital market has further stimulated the integration of industry, university, and research. As of the end of 2022, the total number of R&D personnel of STAR Market companies had exceeded 190,000, with an average of 387 R&D personnel per company, a year-on-year increase of 18%. More than 60% of companies have founding teams composed of scientists, engineers, and other scientific research talents or industry experts. More than 30% have established industry-university-research projects with universities and research institutions. Nearly 50% have participated in national major scientific research projects.

Looking into the future, how will the pilot zone deepen its function?

With the implementation of the comprehensive registration system, and as the STAR Market is about to enter its fifth year, how will the board further deepen its pilot zone function of capital market reforms and continuously promote the institutional improvement, structural optimization, and ecological enhancement of the capital market?

Li Feng told the journalist that in the era of comprehensive registration system, there remain aspects of the STAR Market that can be further improved, such as listing review standards, continuous supervision, and normalized delisting mechanisms. At the same time, it is possible to consider introducing more flexible and internationally accepted trading mechanisms, encouraging more institutional investors to participate in trading on the STAR Market, considering the introduction of more financial products and trading tools, and taking appropriate measures to increase market liquidity and improve trading activity.

In Li Zhan's view, the access threshold of RMB 500,000 yuan for individual investors of the STAR Market has to some extent restricted its liquidity. "The lowering of the access threshold for the STAR Market will be a trend in the long run."

Similarly, Tang Zhehui said that if the trading threshold of the STAR Market can be moderately relaxed, a large number of individual investors will be expected to enter the market, injecting more fresh blood to increase market activity, trading volume, and liquidity, and to boost development and growth of the STAR Market.

It is worth mentioning that the relaxation of the trading threshold for the STAR Market should be considered cautiously in order to balance attracting new investors and safeguarding healthy development of the market. Li Zhan suggests that this process can be carried out in stages and batches, continuously improving investors' risk tolerance and professional investment knowledge in company selection, and make adjustments at an appropriate timing according to the market conditions.

Industry insiders also look forward to further increasing the internationalization level of the STAR Market. At present, the STAR Market has opened channels to attract international capital, such as direct investment in the board through Qualified Foreign Institutional Investors (QFII), Renminbi Qualified Foreign Institutional Investors (RQFII), and the Shanghai-Hong Kong Stock Connect. It is also possible to make allocation on STAR Market stocks through investment in overseas-listed STAR 50 ETFs and other products.

On the one hand, the STAR Market should continuously improve its system to attract more globally influential sci-tech innovation companies to go public, and foster more internationally competitive sci-tech companies. On the other hand, it should continue to improve market regulation and trading mechanisms, further enhance market transparency and reputation, and attract greater attention and participation from international investors.

An official from the SSE stated that moving forward, the Exchange will constantly adhere to the positioning of "first choice for sci-tech innovation enterprises", support the priority of listing for enterprises that fit the positioning of the STAR Market, and continue to play the board's role as a "pilot zone" in such areas as co-investment by sponsor institutions, inquiry transfer for shareholding reduction, and market-making mechanism.