Shanghai Securities News | Full Implementation of Registration System Makes Significant Progress!

From Shanghai Securities News

On the evening of March 3, 2023, the Main Board of the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE) successfully concluded the transfer of companies under review for listing.

According to the statistics of Shanghai Securities News, as of 10 p.m. on March 3, 2023, the SSE and the SZSE have accepted a total of 390 applications from companies under review, including 234 companies applying for IPO, 152 companies applying for refinancing, and 4 companies applying for M&A and reorganization.

On the whole, over 80% of the projects under review were successfully transferred within the specified time frame.

Next, the SSE and the SZSE will continue to review the relevant companies based on their review stage and acceptance order at the China Securities Regulatory Commission (CSRC).

Starting from March 4, 2023, the SSE and the SZSE will begin receiving relevant applications from newly applying enterprises.

Smoothly Transferring 390 Projects

According to the transitional arrangement for the old and new rules, the SSE and the SZSE received applications from the Main Board companies under review for IPO, refinancing, M&A and reorganization from February 20, 2023 to March 3, 2023. The two stock exchanges will start receiving applications from newly applying companies for the Main Board from March 4, 2023.

Data released by the SZSE showed that as of 10 p.m. on March 3, 2023, it had accepted 105 IPO transfer projects, 77 refinancing transfer projects and 2 major asset reorganization transfer projects.

As for the SSE, as of 10 p.m. on March 3, 2023, it had accepted 129 IPO transfer projects,

75 refinancing transfer projects,

and 2 M&A and reorganization transfer projects.

According to data from the CSRC website, as of February 9, 2023, there were a total of 288 IPO projects, 187 refinancing projects and 6 major asset reorganization projects under review for the Main Board of the SSE and the SZSE.

This also means that over 80% of the projects under review were successfully transferred within the specified time frame.

Six IPO Companies Entered Inquiry Stage

Next, the SSE and the SZSE will continue to review the relevant companies based on their review stage and acceptance order at the CSRC.

Specifically, for those companies that have passed the CSRC’s preliminary review but have not yet been reviewed and approved by the Issuance Review Committee, the SSE and the SZSE will continue the review process according to the acceptance order and review results of the CSRC, and schedule review meetings and Listing Committee meetings after the opinions of the preliminary review meetings are implemented.

For those companies that have received feedback from the CSRC but have not yet gone through preliminary review meetings, the SSE and the SZSE will continue to push forward the IPO review work according to the acceptance order and review results of the CSRC. For those companies that have been accepted by the CSRC but have not yet received feedback, the SSE and the SZSE will issue the first round of inquiries within 20 working days after acceptance.

For those Main Board companies under review for refinancing and M&A and reorganization, the same arrangement will be applied.

For Main Board companies under suspension of review, those that have submitted applications to the SSE and the SZSE and have been accepted will continue to be suspended according to relevant regulations if the conditions for suspension have not been eliminated. When the conditions for suspension have been eliminated, the stock exchanges will resume the issuance and listing review after verification.

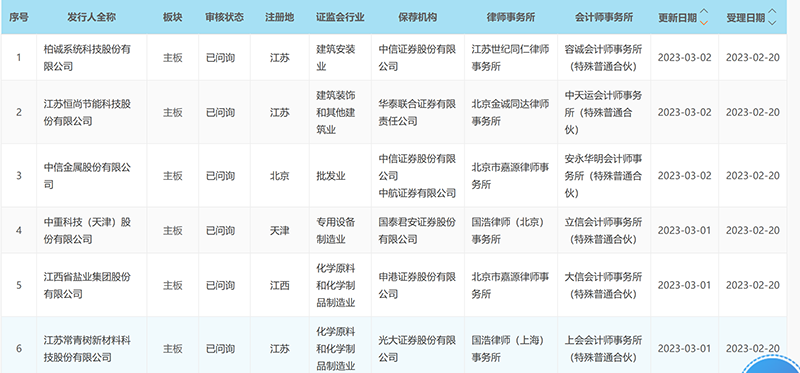

It's worth noting that 6 companies applying for IPO on the Main Board accepted by the SSE have already entered the inquiry stage and completed the first round of inquiries and responses.

Companies that have not been transferred on time will be treated as newly applying companies and will restart the review process together with other new applicants based on the acceptance order of the stock exchanges.

The Main Board of SSE and SZSE Welcoming New Applicants

With the successful conclusion of the transfer of companies under review, the SSE and the SZSE will begin receiving applications from new applicants for listing on the Main Board starting from March 4, 2023.

Investment bankers from several securities companies told Shanghai Securities News that they have already made preparations and plan to submit applications to the SSE and the SZSE as soon as new applications are accepted.

According to relevant regulations, the Review Center of the SSE and the SZSE will begin reviewing application documents in the sequential order of their acceptance and will send the first round of inquiries within 15 working days from the date of acceptance.