Xinhua Finance | Four Pharmaceutical Retail Companies Attend SSE Roadshow: Three Logics Support Industry Development

From Xinhua Finance

On December 2, 2022, a collective performance meeting on the 3rd quarter report of companies in the pharmaceutical retail industry was held at the Shanghai Stock Exchange (SSE) Roadshow Center. Four companies, namely Yifeng Pharmacy Chain Co., Ltd., Lbx Pharmacy Chain Joint Stock Company, DaShenLin Pharmaceutical Group Co., Ltd. and Yunnan Jianzhijia Health-Chain Co., Ltd., attended the meeting. Multiple senior executives gave online briefings on their company's performance in the first three quarters and responded to investors' concerns.

Xinhua Finance Beijing, December 2, 2022 (Lin Zhenghong): On December 2, 2022, a collective performance meeting on the 3rd quarter report of companies in the pharmaceutical retail industry was held at the Shanghai Stock Exchange (SSE) Roadshow Center. Four companies, namely Yifeng Pharmacy Chain Co., Ltd., Lbx Pharmacy Chain Joint Stock Company, DaShenLin Pharmaceutical Group Co., Ltd. and Yunnan Jianzhijia Health-Chain Co., Ltd., attended the meeting. Multiple senior executives gave online briefings on their company's performance in the first three quarters and responded to investors' concerns.

Suggesting good prospects for the industry with three logics

The performance meeting was hosted by Hu Ruobi, Co-Principal Analyst of Pharmaceuticals at Guosheng Securities Co., Ltd. She started with an introduction of the status quo and investment logic of the pharmaceutical retail industry.

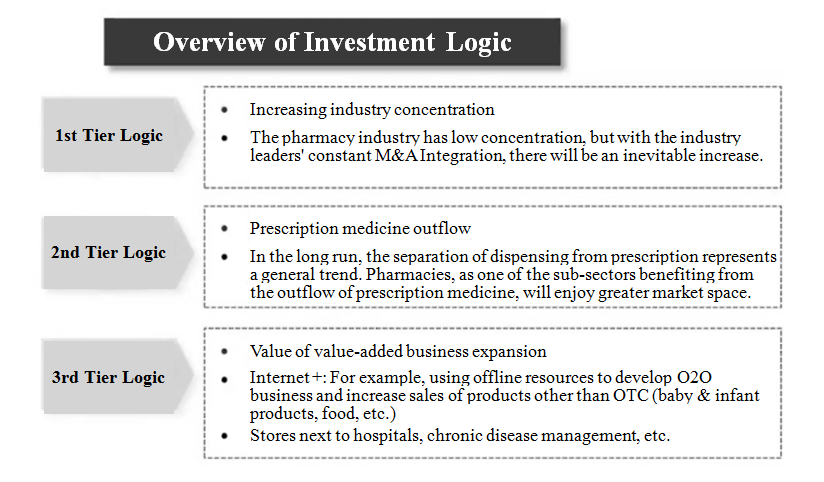

According to Hu, as a typical segment industry with pharmaceutical growth attributes, the pharmaceutical retail industry is also a critical safeguard sector related to the national economy and people's livelihood. There are three logics pointing to good prospects for the industry: increasing industry concentration, prescription medicine outflow, and the value of value-added business expansion.

Regarding the judgment of industry trends, she said that on the one hand, changes in the policy environment have made a difference to the business environment. While small pharmacies are caught in a dilemma, the leading ones keep building up their own strength. On the other hand, since 2017, the outflow of prescription medicine has accelerated due to the 30% limit on medicine in public hospitals, the abolition of medicine markups, the gradual implementation of volume-based procurement, and the connection of pooling accounts with the consumption of special chronic diseases in pharmacies.

Increasing Online business with its limitations

In the subsequent Q&A session, senior executives from the four companies had discussions on a number of industry hot topics, such as pharmaceutical e-commerce and service upgrades.

Fan Wei, secretary of the board of directors of Yifeng Pharmacy Chain Co., Ltd., said pharmacy retail is bound to go online, but at a limited rate. "It will be higher in first-tier cities, average at 10% in second-tier cities, and only at 1-2% in third-tier and below cities and towns."

Feng Shini, secretary of the board of directors of Lbx Pharmacy Chain Joint Stock Company, believed that with the increasingly standardized policy orientation in the industry, there is more of a differentiation competition between pharmaceutical e-commerce and traditional retail pharmacies. "Medicine retail is highly professional, and offline pharmacies have an advantage in this respect". She said the company will actively build online and offline ecological networks to meet the needs of different customers.

Liang Runshi, secretary of the board of directors of DaShenLin Pharmaceutical Group Co., Ltd., said online business in the industry is growing rapidly, but mostly from non-pharmaceutical sales. "In the foreseeable future, medicine retailing will remain largely offline, while online sales will mainly meet the needs of young generation for treating mild diseases."

Li Heng, secretary of the board of directors and chief finance officer of Yunnan Jianzhijia Health-Chain Co., Ltd., held that the pandemic has in a way changed people's consumption habits. The company will work on omni-channel specialization and promote the combination of online and offline business. "Our online business has grown from 10.33% in 2020 to 20.28% at the end of Q3 of this year, with a high compound growth rate."

In terms of service upgrades, senior executives from the four companies agreed that the key is to enhance the professional service capabilities for chronic disease management. On the one hand, they will increase the professionalism of pharmacists; On the other hand, they will equip more stores with smart devices for detecting chronic diseases and set up chronic disease management files for more customers.

Adjustments in pandemic prevention and control policies favoring future performance

Apart from industry hot topics, the senior executives responded to investors' questions about the impact of recent pandemic policy adjustments on future performance.

According to Yifeng Pharmacy Chain Co., Ltd., the COVID-19 pandemic did have an impact on the industry and the company's operations, including restrictions on the flow of people in the affected areas, the window sale of medicine in some stores, and the restricted sale of some products, resulting in a slowdown in the company's growth during the pandemic. However, with the gradual relaxation of the prevention and control policy, the company is gradually picking up its customer flow, leading to higher quarterly revenue and net profit growth. "The four categories are selling well, and with the weather changes, we expect the company to do well in Q4."

Lbx Pharmacy Chain Joint Stock Company indicated that sales of some cold medicines have risen recently on a monthly basis, largely due to changes in pandemic policy. The company will keep sufficient supplies of pandemic prevention materials in accordance with the national pandemic prevention and control requirements to meet people's health and pandemic prevention needs at all times.

DaShenLin Pharmaceutical Group Co., Ltd. also reported that based on the precise adjustment of pandemic prevention and control and the continuous improvement of public awareness of self-protection, sales of the four categories of medicine related to pandemic prevention have steadily increased, which has contributed to the recovery of customer flow in stores and sales of related products. Since Q1 of 2022, the company's overall gross profit margin and profitability have been continuing to recover.