Securities Times | 1,000th Listed Company under Registration Scheme! A-Share to Usher in Critical Leap

From Securities Times

On November 10, 2022, GRINM Semiconductor Materials Co., Ltd. (hereinafter referred to as "GRINM"), was listed on the STAR Market, becoming the 485th listed company on the STAR Market and the 1,000th listed company under the A-share registration scheme.

The registration scheme is a "pivot" project to comprehensively deepen capital market reform. From the STAR Market as a test field to the ChiNext and the Beijing Stock Exchange (BSE), the existing and incremental reform has made steady progress, and the registration scheme reform has moved forward smoothly and rapidly. A large number of "SRDI (Specialized, Refinement, Differential and Innovation)" companies with "key and core technology" and "three creations (innovation, creation, creativity) and four news (new technologies, new industries, new business forms, new models)" have emerged in the capital market.

Now, the registration scheme reform is ushering in a "critical leap". Yi Huiman, Chairman of the China Securities Regulatory Commission (CSRC), recently wrote that, overall, after nearly three years of pilot exploration, the registration scheme framework centering on information disclosure has initially withstood the test of the market. With the continuously improved supporting systems and provision of rule of law, the conditions for fully implementing the stock issuance registration scheme have been basically in place.

The implementation of a comprehensive registration scheme is a necessary move to develop direct financing and support industrial transformation and upgrading. According to market expectations, the comprehensive implementation of the registration scheme will further increase the vitality and resilience of China's capital market, improve the virtuous cycle of science and technology, industry and capital, and enhance the efficiency of the capital market to serve high-quality economic development.

Steady Progress of "Pivot" Project

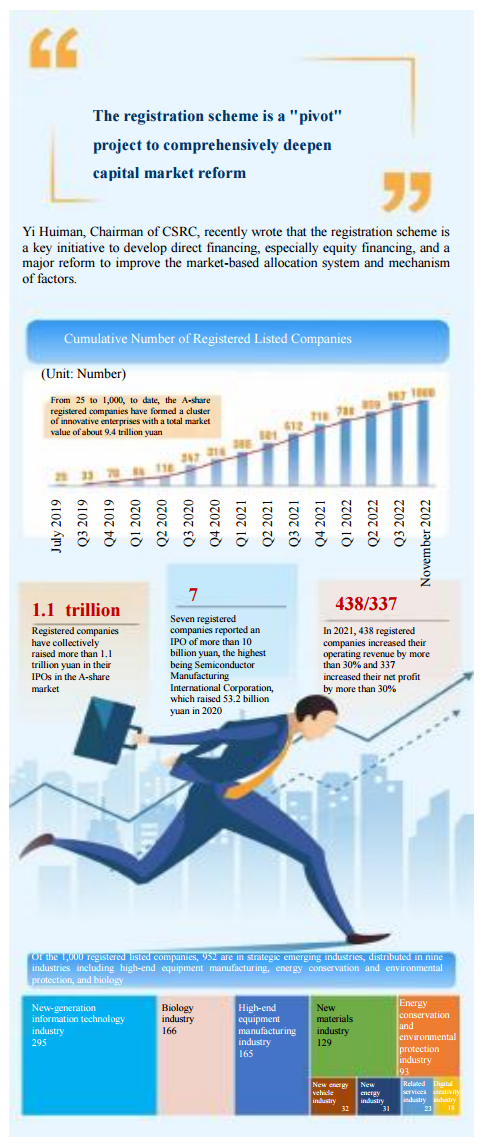

On July 22, 2019, the first batch of 25 companies debuted on the STAR Market, marking the official launch of the registration scheme.

A few days ago, Yi Huiman wrote that "the registration scheme is a 'pivot' project to comprehensively deepen capital market reform, a key initiative to develop direct financing, especially equity financing, and a major reform to improve the market-based allocation system and mechanism of factors."

The terms "pivot" project, key initiative, major reform… highlight the significance of the registration scheme reform. General principles run through the whole process of the registration scheme reform, namely pulling one hair and the whole body is affected and pursuing progress while ensuring stability.

In April 2020, the ChiNext reform and registration scheme pilot kicked off. The registration scheme reform took a critical step to link the past and the future, extending the pilot from the incremental market to the existing market; in November 2021, the BSE was opened and it has the attribute of "registration scheme" since its inception.

Under the registration scheme, the capital market has more inclusive listing conditions, more transparent review standards, more predictable review time limits, and more refined regulatory services. As high-quality enterprises of different industries, sizes and models can finance, grow and develop through the capital market, a large number of outstanding enterprises in the fields of science and technology, biomedicine, Internet and other new economy set foot on the capital market to seek opportunities for transformation and development.

From 25 to 1,000, to date, the 1,000 A-share registered companies have formed a cluster of innovative enterprises with a total market value of about 9.4 trillion yuan. Of these, 485 companies listed on the STAR Market, which concentrate on six strategic emerging industries, create their most distinctive labels with "key and core technology"; 393 companies listed on the ChiNext, which cover nine strategic emerging industries, promote the country's economic structural transformation and industrial upgrading; 122 companies listed on the BSE, which involve industrial materials, information technology, medicine and health, carbon peaking and carbon neutrality, consumption and other diversified innovation fields, constantly bring together SRDI "little giants".

In addition, of the 1,000 registered listed companies, 952 are in strategic emerging industries, distributed in nine industries including high-end equipment manufacturing, energy conservation and environmental protection, and biology. Among them, 295 companies are in the new-generation information technology industry, accounting for the largest; more than 120 companies are in the three industries of new materials, high-end equipment manufacturing and biology.

In an interview with the Securities Times's journalist, Tian Lihui, vice president of Guangxi University and president of Nankai University Institute of Finance and Development, said that the registration scheme reform can boost the size and quality of China's capital market by leaps and bounds. Under the inclusive standards of the registration scheme, the number of listed companies in China has increased rapidly and the scale of the capital market has grown significantly.

Favorable Ecology Thanks to Registration Scheme Reform

Under the registration scheme, an increasing number of listed companies have achieved leapfrog development, which has contributed to the qualitative change of the overall structure of A-shares and continued to enhance the content of technology and innovation.

According to the statistics of GF Securities, under the registration scheme, the industrial structure of A-shares has been upgraded. First, the proportion of market value of A-share information technology and high-end manufacturing industries increased, while that of the cyclical and financial real estate sectors shrunk significantly. As of September 2022, the market value of China's growth industries accounted for 24.27%, a notable increase from about 10% in 2005. Second, the market value of A-share strategic emerging industries increased rapidly, from less than 2% in 2019 to about 10% in the first half of this year.

Yu Lingqu, vice director of Department of Financial Development and State Assets and State-Owned Enterprises of China Development Institute (Shenzhen), told the journalist of the Securities Times that the registration scheme reform is far-reaching because it promotes the capital market structure to adapt to the needs of industrial structure and industrial transformation and upgrading, thus enhancing the capital market's ability to serve the real economy. Given the limited tangible assets of new economy enterprises and their weak profitability in their early stage of development, the adoption of an approval system with unified standards is unlikely to serve new economy enterprises and emerging industries. Through the registration scheme reform, the financing ability of new economy enterprises has improved significantly.

The registration scheme is constantly bringing vitality into the real economy. According to Wind's statistics, registered companies have collectively raised more than 1.1 trillion yuan in their IPOs in the A-share market, bringing most of them leaps and bounds. So far, 7 registered companies reported an IPO of more than 10 billion yuan, the highest being Semiconductor Manufacturing International Corporation, which raised 53.2 billion yuan in 2020, followed by BeiGene, Ltd. with 22.1 billion yuan and Yihai Kerry Arawana Holdings Co., Ltd. with 13.9 billion yuan.

"The official launch of the STAR Market has opened up favorable financing channels for sci-tech innovation companies, represented by semiconductor enterprises." Li Wei, executive vice-president and secretary of the board of directors of National Silicon Industry Group Co., Ltd., told the journalist of the Securities Times.

Betta Pharmaceuticals Co., Ltd. is a biopharmaceutical company on the ChiNext. Its main product, Conmana, is China's first self-developed small molecule targeted anti-cancer drug. Ding Lieming, chairman of the Board and CEO of Betta Pharmaceuticals Co., Ltd., said in an interview with the journalist of the Securities Times that ChiNext fully matches its positioning of serving innovative and entrepreneurial enterprises, understands and meets the financing needs of enterprises at different stages of development, and provides them with an active capital market platform. In response to the development stages and characteristics of enterprises, it formulates more targeted service measures and regulatory policies to improve the level of corporate governance and the effectiveness of information disclosure.

As representatives of emerging strategic industries, newly listed registered companies have performed well in both operating revenues and profits in the past two years. Statistics showed that among the 1,000 registered companies, 438 increased their operating revenue by more than 30% and 337 increased their net profit by more than 30% in 2021.

With the advancement of the comprehensive registration scheme, the A-share capital market has accelerated the survival of the fittest. As the market's investor structure becomes increasingly institutional, A-share investors are making more fundamental and market-oriented investments. According to data, more than 40 A-share listed companies have been forced to delist this year, marking the basic formation of a regular delisting system of "proper entry and exit".

Also, the sound momentum has kept increasing the attractiveness of China's capital market in the medium and long term. "Foreign investment in China's capital market has shown remarkable resilience." Foreign investors poured 63.2 billion yuan into A-shares through the Shanghai and Shenzhen-Hong Kong Stock Connect from January to August this year, as Fang Xinghai, vice chairman of CSRC, revealed at the China International Finance Annual Forum 2022.

Advice and Suggestions from Market Participants

As the 14th Five-Year Plan, the 2021 Central Economic Work Conference, the 2022 Government Work Report and the CSRC's 2022 Mid-Year Regulatory Work Conference make new arrangements for the next stage of registration scheme reform, the stock issuance registration scheme is expected to be introduced in the whole market soon.

Yi Huiman said that next the CSRC will firmly uphold the correct direction of reform, and scientifically deal with such issues as the review and registration mechanism, the positioning of each board, and the guidance of the compliant and healthy development of capital. It will make meticulous preparations in rules, business and technology to ensure the smooth implementation of this major reform.

There are also advice and suggestions from all sides of the market for the "critical leap" of implementing the comprehensive registration scheme reform, with a view to jointly promoting the registration scheme reform and the steady and long-term operation of the basic system of capital market.

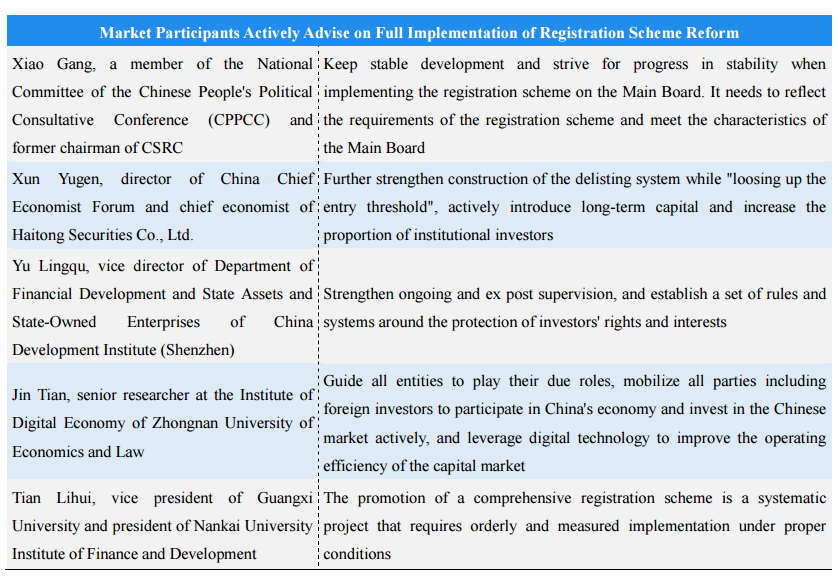

During this year's "Two Sessions", Xiao Gang, a member of CPPCC and former chairman of CSRC, said that the pilot of registration scheme reform has been launched in the STAR Market, the ChiNext and the BSE with considerable results. All parties showed extensive recognition and had a high sense of gain, which accumulated experience and created conditions for the full implementation of the registration scheme. The focus and difficulty of implementing a comprehensive registration scheme lie in the reform of the Main Board. Unlike the STAR Market and the ChiNext, the Main Board of the SSE and the Shenzhen Stock Exchange (SZSE) involve a large number of stock listed companies and investors. These companies are relatively large and mature in their business. By industry distribution, they are mostly in traditional industries.

"Keep stable development and strive for progress in stability when implementing the registration scheme on the Main Board. It needs to reflect the requirements of the registration scheme and meet the characteristics of the Main Board." Xiao Gang said that although it is both about Main Board reform, the SSE and SZSE have different relevant rules. Therefore, there should be further research when making reform schemes to ensure smooth implementation. Besides, the mechanism should be further optimized in the process of comprehensively implementing the registration scheme. The exchanges should strengthen their review responsibilities, while the CSRC should emphasize coordination and supervision management, thus constantly improve the quality and efficiency of review and registration.

"China's comprehensive deepening of the registration scheme reform today is also in line with the strategic needs to develop emerging industries." Xun Yugen, director of China Chief Economist Forum and chief economist of Haitong Securities Co., Ltd., said that in order to create a market environment that suits the comprehensive registration scheme, relevant institutional construction should follow in parallel. On the one hand, as the registration scheme will bring more A-share listed companies, we should strengthen the construction of the delisting system while "loosing up the entry threshold"; on the other hand, we should actively introduce long-term capital and increase the proportion of institutional investors to ensure the stable and orderly development of the capital market.

In terms of speeding up the regular delisting mechanism of the A-share market, Xun Yugen proposed to add more flexible qualitative delisting indicators, implement differentiated delisting standards for different sectors, and further align the delisting system of A shares with mature markets. In the future, with the implementation of the A-share comprehensive registration scheme and the accelerated formation of the regular delisting mechanism, A-share listed companies will go through the survival of the fittest and show increasingly obvious differentiation. Gradually marginalized small-cap companies will be promptly and effectively removed to optimize the efficiency of market resource allocation.

"The registration scheme will make listings more diversified and it will be harder to protect investors' rights and interests." Yu Lingqu said that regulators should strengthen ongoing and ex post supervision, and establish a set of rules and systems around the protection of investors' rights and interests, thereby providing investors with sustainable asset-based income in a real sense, attracting the continuous inflow of social wealth into the capital market, and providing sufficient capital for the development of high-quality enterprises.

In an interview with the Securities Times's journalist, Jin Tian, a senior researcher at the Institute of Digital Economy of Zhongnan University of Economics and Law, suggested three aspects of considerations and layouts: first, further improve the institutional arrangements to guide all entities including market intermediaries to play their due roles; second, improve internal and external circulations to mobilize all parties including foreign investors to participate in China's economy and invest in the Chinese market actively; third, enhance technical capabilities and leverage digital technology to improve the operating efficiency of the capital market and hold on to the bottom line of no systemic risk.

Tian Lihui said that the promotion of a comprehensive registration scheme is a systematic project that requires orderly and measured implementation under proper conditions. This means that when promoting the registration scheme reform of the Main Board market, details should be taken into account to formulate and roll out plans in due course, so as to promote the moderate growth of China's capital market and better empower the real economy.