Index-based Investment In One Picture

Translated from Shanghai Stock Exchange Investor Education

Index Encyclopedia No.12: SSE 180 Index

Editor's Notes

The index system has grown rapidly in recent years, showing higher market recognition and a rising trend in index-based investment. Shanghai Stock Exchange (SSE) Investor Education, together with China Fund News and China Securities Index Co., Ltd. (CSI), jointly launched a special investor education program "Index-based Investment in One Picture" to provide investors with comprehensive and professional interpretation and unravel the keys to index-based investment.

Index Positioning:

The SSE 180, as one of the representative indexes of the SSE large-caps, consists of 180 securities with large scale and good liquidity. It is the component index that best reflects the overall landscape of the SSE and the linchpin index of the SSE broad-based index system. The compilation methodology of SSE 50 and SSE 380 are directly linked to it.

Index Revision:

To better reflect the overall performance of core listed companies' securities in the Shanghai stock market, the SSE and CSI recently announced revisions to the compilation plan of the SSE 180 Index, which was officially implemented on December 16, 2024.

[Content of Revisions]

●Further improve the market cap coverage of the index and enhance its representativeness.

●Set weight limits on individual stocks and top 5 constituents, and introduce industry balance rules.

●Exclude securities of listed companies rated C or below in the CSI ESG evaluation.

[Impact of Revisions]

●Higher Representativeness of the SSE market.

●Better alignment with the growth of new quality productive forces.

●Better reflection of changes in the capital market structure and industrial transformation.

●Higher index return and stability.

Compilation Method:

●Liquidity screening: The average daily turnover in the past year ranked among the top 90% of securities in the index universe.

●Sustainable development: Exclude securities rated C or below in the CSI ESG evaluation.

●Total market cap sampling: The top 180 securities with highest daily average total market cap in the past year are selected as constituents.

●Industry balance: the total weight of constituents in each sector is the same portion in terms of free-float market capitalization as the corresponding sector in the universe.

Industry Distribution:

After revision, the SSE 180 Index constituents will better reflect the changes and trends of the overall industry structure in the SSE market, with a prominent share in "new economy" sectors. According to CSI sector classification, the top 3 sectors of the constituents are industry (21%), finance (21%), and information technology (13%), with industry, information technology, healthcare, and communication services accounting for more than 44%.

Market Capitalization Distribution:

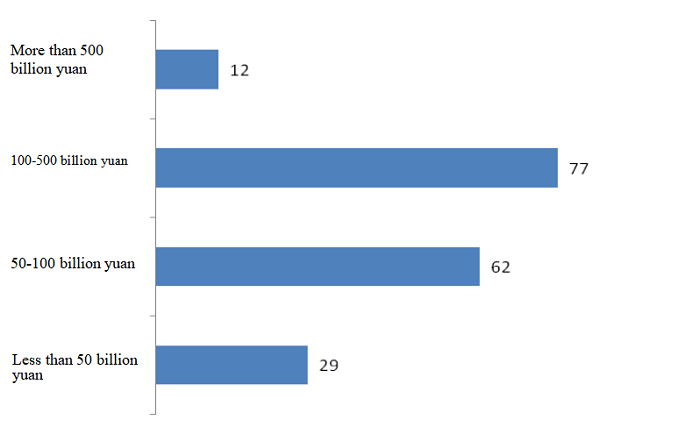

Market Capitalization Distribution of SSE 180 Index Constituents

Note: Data are as of November 29, 2024.

After revision, the total market capitalization of the SSE 180 Index constituents ranges from 28.4 billion yuan to 1.9 trillion yuan, covering 60% of the total market capitalization of SSE A-shares with an average market capitalization of about 170 billion yuan and a median market capitalization of about 100 billion yuan.

Top 10 Constituents:

| Ranking | Security Name | CSI Primary Sector |

| 1 | Kweichow Moutai Co., Ltd. | Main consumption |

| 2 | Ping An Insurance (Group) Company of China, Ltd. | Finance |

| 3 | Jiangsu Hengrui Pharmaceuticals Co., Ltd. | Healthcare |

| 4 | Zijin Mining Group Company Limited | Raw materials |

| 5 | China Merchants Bank Co., Ltd. | Finance |

| 6 | China Yangtze Power Co., Ltd. | Utilities |

| 7 | Semiconductor Manufacturing International Corporation | Information technology |

| 8 | Beijing-Shanghai High Speed Railway Co., Ltd. | Industry |

| 9 | CITIC Securities Company Limited | Finance |

| 10 | Wuxi AppTec Co., Ltd. | Healthcare |

Index Fundamentals:

The SSE 180 Index constituent companies are relatively mature in development and stable in operation. After revision, the net profit attributable to the parent company of SSE 180 Index constituents increased by 5.6% year-on-year in the first three quarters of 2024, and 14.2% year-on-year in the third quarter and 7.0% quarter-on-quarter, reflecting strong resilience and risk-proof characteristics.

Index Investibility:

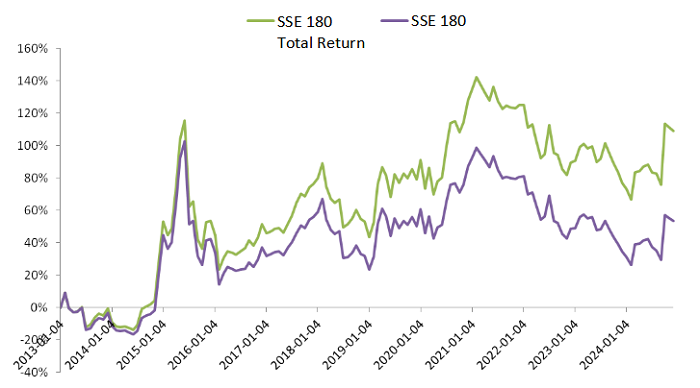

In terms of index performance, the dividend yield of the SSE 180 Index reached 2.9%, up by 54% since 2013. The total return index increased by 110%, and the annualized returns reached 3.8% and 6.6% respectively.

After revision, the SSE 180 Index is better performing and stabler. The revision will lift the annualized return of the index since 2013 by about 1 percentage point, reduce the annualized volatility by 0.1 percentage point, enhancing the investment value of the index.

Trend of Index over the Past 10 Years

Note: Data are as of November 29, 2024.

Linked Products:

Recently Issued SSE 180 Products

| No. | Subscription Code | Product | Issue Time |

| 1 | 530183 | E Fund SSE 180ETF | 11.29-12.13 |

| 2 | 530683 | Industrial Bank SSE 180ETF | 12.9-12.20 |

| 3 | 510043 | Penghua SSE 180ETF | 12.12-12.20 |

| 4 | 530303 | Huatai-Pinebridge SSE 180ETF | 12.16-12.25 |

| 5 | 530583 | China Southern SSE 180ETF | 12.16-12.25 |

| 6 | 530083 | Tianhong SSE 180ETF | 12.17-12.27 |

| 7 | To be issued | Ping An SSE 180ETF | |

| 8 | To be issued | Yinhua SSE 180ETF |

Existing Index Products

| No. | Code | Product |

| 1 | 510180 | Huaan SSE 180ETF |

| 2 | 519180 | Wanjia 180 Index Fund |

The above information is provided for reference purposes only and does not constitute investment advice.