Introduction of Publicly Offered REITs

Ⅰ Definition of Publicly Offered REITs

The publicly offered real estate investment trust funds (hereinafter as publicly offered REITs) refer to standardized financial products that are publicly raised from investors to form fund assets in accordance with the law, and hold real estate projects through special purpose vehicles such as real estate asset-backed securities, whose fund managers actively manage the above-mentioned real estate projects and distribute most of the income generated to investors. According to regulations, the publicly offered REITs are listed and traded on the stock exchange.

Real estate asset-backed securities refer to those issued to investors representing real estate property or a share of property rights and interests that use the cash flow generated by real estate projects as the source of reimbursement and the real estate asset-backed special plans as the carrier according to the Regulations on the Asset Securitization Business of Subsidiaries of Securities Companies and Fund Management Companies and other relevant regulations.

Ⅱ Significance of Publicly Offered REITs

Publicly offered REITs are internationally accepted assets. They have the characteristics of high liquidity, relatively stable returns, and strong security. They can effectively revitalize existing assets, broaden social capital investment channels, and increase the proportion of direct financing, hence enhancing the quality and efficiency of capital market services for the real economy. In the short term, it helps extensively raise project capital and reduce debt risks as an effective policy tool to stabilize investment and make up for shortcomings; in the long term, it facilitates the conversion from savings into investment and deleveraging of the real economy, and promotes the healthy development of real estate investment financing towards a market-based and standardized direction.

Ⅲ Structure Features of Publicly Offered REITs

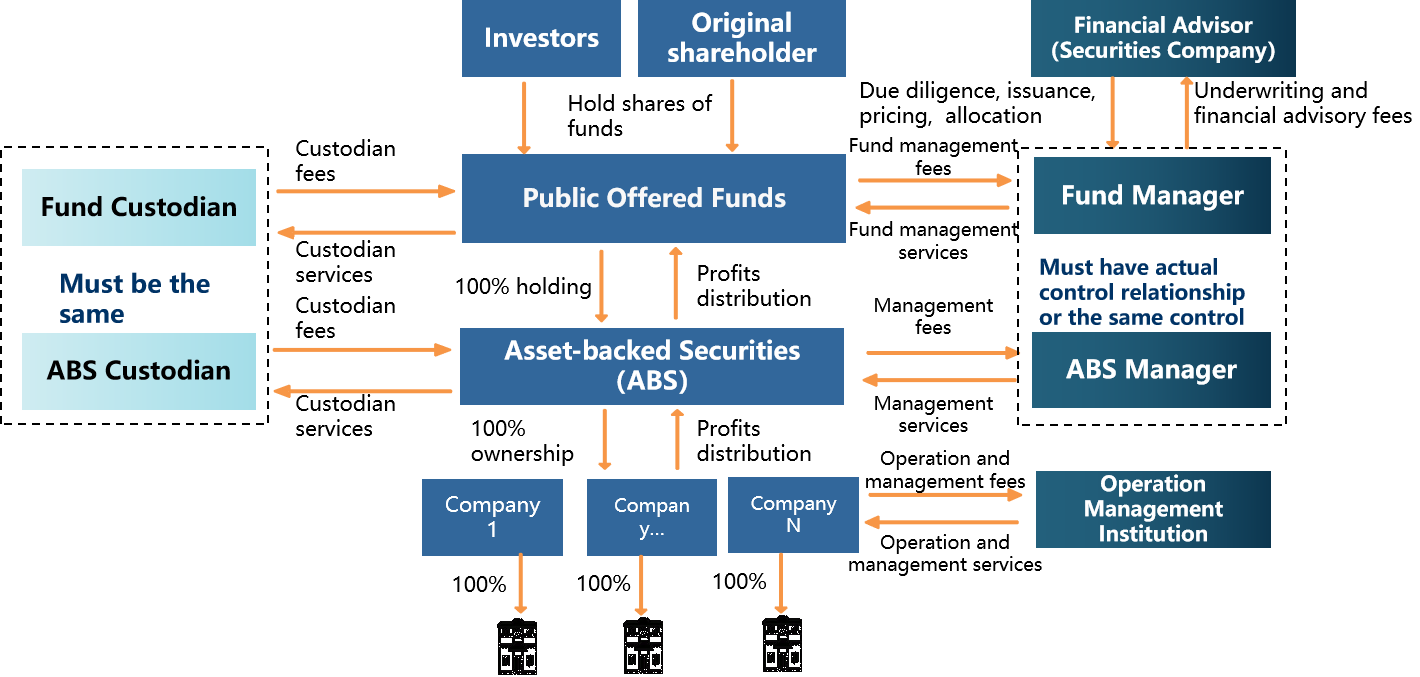

First, over 80% of the fund’s assets are invested in real estate asset-backed securities and hold all of its shares; the fund holds all the equity of the project company through real estate asset-backed securities;

Second, the fund obtains full ownership or operating rights of real estate projects through special purpose vehicles such as real estate asset-backed securities and project companies;

Third, fund managers take the initiative to operate and manage real estate projects, with the main purpose of obtaining stable cash flows such as rent and fees for real estate projects;

Fourth, closed-end operation is adopted and the income distribution ratio shall not be less than 90% of the annual distributable amount of the combined fund.

Structure of REITs

Ⅳ Product Features of Publicly Offered REITs

Publicly offered REITs can be classified as a kind of securities that go in tandem with stocks, bonds, funds, and derivatives. The products have the following characteristics:

First, publicly offered REITs can revitalize existing assets. At the same time, the product can provide incremental investment funds and improve debt levels through deleveraging, and help companies transform to "asset-light" operating models. In this way, the capital market can better serve the real economy;

Second, publicly offered REITs products use 90% of the fund’s annual distributable profits for distribution, with a high proportion of dividends. And because of the clear ownership of real estate projects, the cash flow is continuous and stable, making a satisfactory return on investment. The investment varieties are diversified and investors can easily invest in real estate projects with poor liquidity;

Third, the rules for publicly offered REITs products are transparent and sound. A listing review system has been established in accordance with the requirements for public offerings of securities, and complete specific business rules for sale, listing, transaction, acquisition, information disclosure, and delisting have been formulated. Real estate projects can use the open and transparent mechanism of the capital market to guide financial funds to participate in the construction of physical projects through capital market financing to achieve high-quality development.