Qualification for Qualified Foreign Investor License

An applicant for the qualification as a qualified foreign investor shall meet the following requirements:

1. the applicant shall be in sound financial conditions and good credit standing with experiences in securities and futures investment;

2. the applicant's managerial personnel in charge of domestic investments shall meet relevant professional requirements of the applicant's domicile country or region (if such requirements exist);

3. the applicant shall have sound and effective governance structure, internal control system, and compliance management regime, and, in accordance with relevant regulations, appoint a supervisor to oversee the legality and compliance of the applicant's domestic investment;

4. the applicant's operation is well-managed and has not been subject to any major punishment by regulatory authorities in the latest 3 years or since its establishment; and

5. the applicant does not have any circumstances that would have a significant impact on the operation of the domestic capital market.

Investment Quota (abolished)

Aggregate Quota

There used to be an aggregate quota limit for QFII and RQFII scheme respectively, and in September 2019, the PBC and SAFE announced that the aggregate quota limits for QFII and RQFII are cancelled.

Individual Quota

Previously, a qualified investor (QFII or RQFII), after obtaining the license from the CSRC, may obtain an investment quota no higher than a certain proportion of its assets or the securities assets under management through filing to the SAFE.

In September 2019, the PBC and SAFE announced that it would abolish the investment quota restrictions for QFII and RQFII.

In May 2020, the PBC and SAFE revised the regulation on funds of Foreign Institutional Investors, restrictions on investment quota of Qualified Foreign Investors were removed. Qualified Foreign Investors no longer need to apply for any investment quota from SAFE. Instead, they shall entrust their main custodians to make a registration with the SAFE.

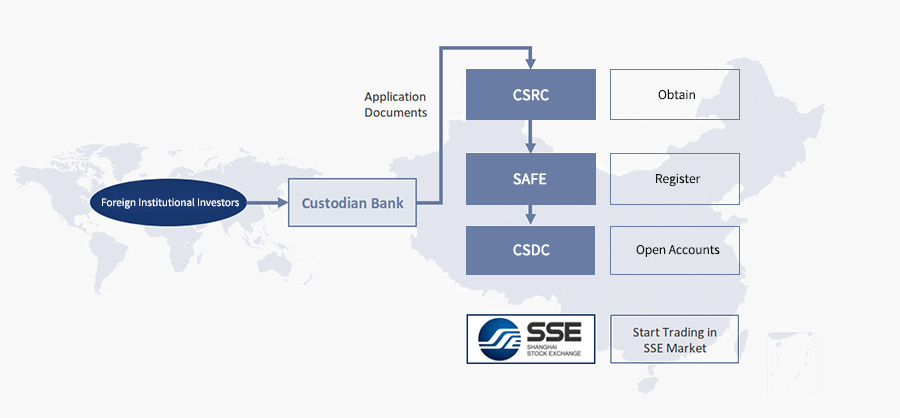

Application Process

| 1. Appoint Custodian | Appoint a custodian bank and prepare application documents |

|---|---|

| 2. Submit Application | Submit the application to the CSRC through custodian |

| 3. Obtain Investment License | The CSRC will examine the application documents and make a decision within 10 business days of accepting the application |

| 4. Register | Register at the SAFE through custodian |

| 5. Open Accounts |

Open FX accounts and/or RMB accounts with custodian Open securities accounts with CSDC |

| 6. Start Trading |

Transfer Funds (and conduct FX conversion) Choose brokers for trading execution |