Shanghai Securities News|32 Unprofitable Companies in the SSE STAR Market to Be Included in the Science and Technology Innovation Growth Tier

Translated from Shanghai Securities News—www.cnstock.com

(Shanghai Securities News, www.cnstock.com) (Reporter He Xinyi) On June 18, the China Securities Regulatory Commission issued Opinions on Setting up a Science and Technology Innovation Growth tier in the SSE STAR Market to Enhance Institutional Inclusiveness and Adaptability, specifically setting up a science and technology innovation growth tier in the SSE STAR Market. The Shanghai Stock Exchange (SSE) drafted the SSE STAR Market Self-Regulatory Guidelines No. 5—Science and Technology Innovation Growth Tier (Draft for Comments) (hereinafter referred to as the Guidelines for the Science and Technology Innovation Growth Tier). The document made specific requirements regarding the positioning of the science and technology innovation growth tier, inclusion and transfer conditions, information disclosure requirements, risk disclosure, and other aspects.

The Guidelines for the Science and Technology Innovation Growth Tier specified that newly added SSE STAR Market companies that were unprofitable at the time of listing (hereinafter referred to as "incremental companies") would be included in the science and technology innovation growth tier from the date of listing. SSE STAR Market companies that were listed before the release of the Guidelines for the Science and Technology Innovation Growth Tier and have not achieved initial profitability after listing (hereinafter referred to as "existing companies") would be included in the science and technology innovation growth tier from the date of the release of the guidelines (official draft).

The Guidelines for the Science and Technology Innovation Growth Tier specifically emphasized that not making a profit at the time of listing means that the lower of the company's audited net profit before and after deducting non-recurring gains and losses in the fiscal year before its listing is negative.

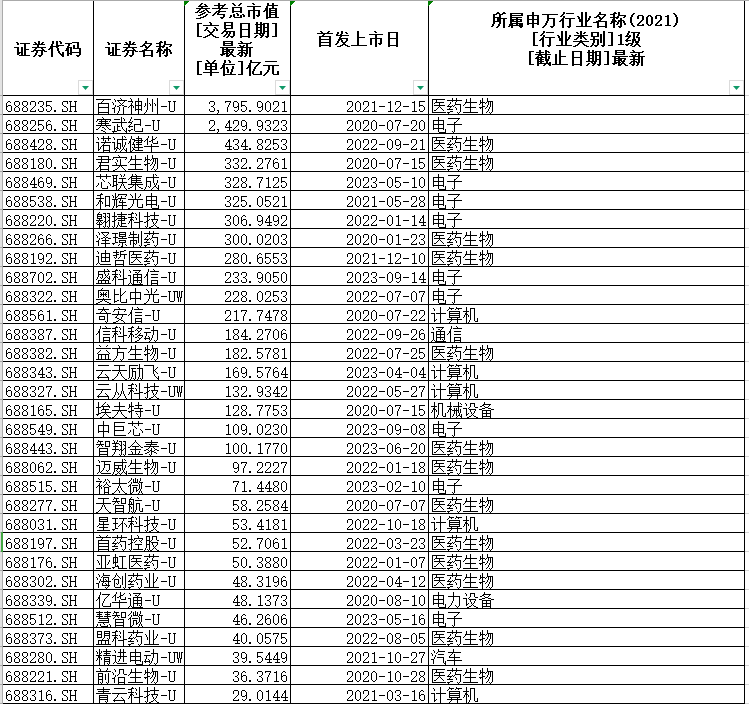

According to statistics from the reporter of Shanghai Securities News, a total of 54 unprofitable companies have been listed on the SSE STAR Market. To date, 22 companies have achieved profitability after listing, and 32 have not made any profit. According to the requirements of the Guidelines for the Science and Technology Innovation Growth Tier, the aforementioned 32 companies will be included in the science and technology innovation growth tier from the date of the release of the guidelines (official draft).

Data source: Choice, Eastmoney

Specifically, the 32 existing companies that have not made any profit include: Suzhou Zelgen Biopharmaceuticals Co., Ltd., Shanghai Junshi Biosciences Co., Ltd., Frontier Biotechnologies Inc., Qingcloud Technologies Corp., Everdisplay Optronics (Shanghai) Co., Ltd., Jing-Jin Electric Technologies Co., Ltd., BeiGene, Ltd., Dizal (Jiangsu) Pharmaceutical Co., Ltd., Mabwell (Shanghai) Bioscience Co., Ltd., ASR Microelectronics Co., Ltd., Jiangsu Yahong Meditech Co., Ltd., Shouyao Holdings Co., Ltd., Hinova Pharmaceuticals Inc., Cloudwalk Technology Co., Ltd., Inventisbio Co., Ltd., ORBBEC INC., Shanghai MicuRx Pharmaceutical Co., Ltd., Innocare Pharma Limited, CICT Mobile Communication Technology Co., Ltd., Transwarp Technology (Shanghai) Co., Ltd., Motorcomm Electronic Technology Co., Ltd., Shenzhen Intellifusion Technologies Co., Ltd., Tinavi Medical Technologies Co., Ltd., Qi An Xin Technology Group Inc., Cambricon Technologies Corporation Limited, Beijing SinoHytec Co., Ltd., EFORT Intelligent Equipment Co., Ltd., Smarter Microelectronics (Guangzhou) Co., Ltd., United Nova Technology Co., Ltd., Chongqing Genrix Biopharmaceutical Co., Ltd., Suzhou Centec Communications Co., Ltd., and Grandit Co., Ltd.

In terms of enterprise transfers, to improve the investment risk screening mechanism for unprofitable science and technology innovation-driven enterprises and strengthen the requirements for incremental companies to be transferred out of the growth tier, it is clarified that the conditions for incremental companies to be transferred out are to meet the first set of listing standards of the SSE STAR Market. That is, "the net profit in the past two years was positive and the cumulative net profit is no less than 50 million yuan" or "the net profit in the previous year was positive and the operating income is no less than 100 million yuan".

Additionally, the old and new conditions for transferring out existing companies before the reform have been "separated". The condition for transferring out existing companies is still achieving initial profitability after listing. The aim is to reduce the impact of the reform on existing companies and maintain the stability of investors' expectations for participating in transactions of existing companies. In terms of transfer procedures, an adjustment mechanism for the science and technology innovation growth tier has been established. Companies are required to disclose the announcement that they meet the conditions and will be transferred out of the science and technology innovation growth tier while disclosing their annual reports. SSE shall promptly transfer the companies out of the science and technology innovation growth tier.

The above information is provided for reference purposes only and does not constitute investment advice.